- Transportation Efficiencies

- EV Charging

- EV Charging

- Clean Transportation

- Clean Transportation

EV Charging Companies Going Global

Commercial EV charging companies are starting to go truly global, supported by major investments coming from the energy sector and automakers. These investments will see companies enter new markets with the potential to ramp up in volume. Since plug-in vehicle (PEV) sales started in 2010, the commercial charging market has been geographically compartmentalized, with few companies based in North America and Europe expanding outside their home region. This was especially true once the large multinationals like Siemens and Schneider Electric pulled back from the market, leaving it to the smaller startup companies that needed to tend carefully to their cash flow. However, large companies are returning to the charging market in anticipation of it being on the verge of a high growth period, and they are announcing their intention to become global players.

Gearing Up

Last year, RWE spun off and rebranded its renewables business, including EV charging, to innogy. It announced innogy would target the United States for its charging market, one of the biggest PEV markets with significant growth potential for infrastructure.

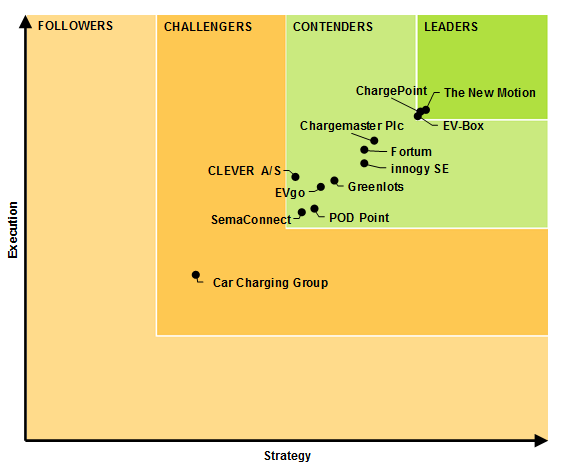

Then in March, ENGIE acquired EV-Box, which has one of the world’s largest charging networks. EV-Box ranked as a leader in the Guidehouse Insights Leaderboard Report: EV Charging Network Companies last year on the strength of its market share, its multiple capabilities as a manufacturer and a software developer, and its relationships throughout key European markets.

The Guidehouse Insights Leaderboard Grid

(Source: Guidehouse Insights)

EV-Box has recently entered the competitive North American charging market with its charger offerings. Entering the North America market seemed ambitious, as the company was a startup with plenty of market to play in throughout Europe without crossing the ocean to tackle North America. However, having a global energy giant like ENGIE behind it could provide EV-Box with the support it needs to pursue its expansion efforts.

Developing New Products and Relationships

It still won’t be easy. Getting a foothold in a new market requires not only developing new products, but more importantly, also establishing the web of relationships needed to secure customers and installation sites. This is a time consuming and therefore expensive process, which is one reason the large multinationals—or companies backed by large multinationals—will have an advantage in this market over the smaller players in the long run. Multinationals looking to come back to the market as growth finally ramps up may find that the startups that have established significant market share and have very large public charging networks will be an easy route to establishing a beachhead. Even companies that have smaller installation bases but dominant market share in a particular country or subregion in Europe or North America could be attractive targets.

ENGIE and innogy may be the thin edge of the wedge in terms of energy companies wading into the charging market, but they are not the only companies with big pockets that are seeking charging company partners. ChargePoint, the leader in the North American charging market, secured $82 million in a funding round led by Daimler in March. The funding will support a stronger push into the European market for ChargePoint.

Maintaining a Long-Term Perspective

While all this activity is encouraging as a sign of confidence in the charging market, success in this market will still require a long-term perspective. There is significant growth, but it will still be years before charging is a well-established and high volume market. It is also a market that is still overly dependent on financial support for deployments, whether from interested stakeholders like the car companies or from governments, and growth will not be even across all the market segments of public, workplace, and private chargers. These dynamics do still favor the companies with sufficient funding to stay the course.